TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant ☒ | | |

| | | Filed by a party other than the Registrant ☐ |

Filed by the Registrant xFiled by a Party other than the Registrant o

Check the appropriate box:

oPreliminary Proxy Statement

oConfidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

xDefinitive Proxy Statement

oDefinitive Additional Materials

oSoliciting Material Pursuant to §240.14a-12 ☐ | | | Preliminary Proxy Statement |

☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | | | Definitive Proxy Statement |

☐ | | | Definitive Additional Materials |

☐ | | | Soliciting Material under §240.14a-12 |

URBAN EDGE PROPERTIES

(Exact nameName of Registrant as specifiedSpecified in its charter)Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Theother than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

☒ | | | No fee required |

x ☐

| No fee required. |

| | | Fee paid previously with preliminary materials |

o ☐

| | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 |

| |

(1) | Title of each class of securities to which transaction applies: |

| |

(2) | Aggregate number of securities to which transaction applies: |

| |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

(4) | Proposed maximum aggregate value of transaction: |

| |

o

| Fee paid previously with preliminary materials. |

| |

o

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) | Amount Previously Paid: |

| |

(2) | Form, Schedule or Registration Statement No.: |

TABLE OF CONTENTS

2024

NOTICE OF ANNUAL MEETING

AND PROXY STATEMENT

May 1, 2024

New York, NY

TABLE OF CONTENTS

March 29, 201822, 2024

Dear Shareholder:

The Board of Trustees and officers of Urban Edge Properties join me in extending to you a cordial invitation to attend the 20182024 annual meeting of our shareholders. This meetingshareholders (the “Annual Meeting”). The Annual Meeting will be held on Wednesday, May 9, 2018,1, 2024, at 9:00 a.m. Eastern Time, atTime. The Annual Meeting will be held entirely online. You can attend the officesAnnual Meeting online by visiting www.virtualshareholdermeeting.com/UE2024, where you will be able to participate in the Annual Meeting live, submit questions and vote. Please see the “Questions and Answers” section of Goodwin Procter LLP, The New York Times Building, 620 Eighth Avenue, New York, NY 10018.this proxy statement for more details regarding the logistics of the virtual Annual Meeting, including the ability of shareholders to submit questions during the Annual Meeting, and technical details and support related to accessing the virtual platform for the Annual Meeting.

As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we have provided access to our proxy materials over the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials, or E-proxy notice, to our shareholders of record as of the close of business on March 12, 2018.4, 2024. The E-proxy notice contains instructions for your use of this process, includingregarding, among others, how to access our proxy statement and annual report and how to authorize your proxy to vote online. In addition, the E-proxy notice contains instructions on how you may receive a paper copy of the proxy statement and annual report or elect to receive your proxy statement and annual report over the Internet.

If you are unable to attend the annual meeting in person,Annual Meeting, it is very important that your shares be represented and voted at the meeting.Annual Meeting. You may authorize your proxy to vote your shares over the Internet as described in the E-proxy notice. Alternatively, if you received a paper copy of the proxy card by mail, please complete, date, sign and promptly return the proxy card in the self-addressed stamped envelope provided. You may also authorize your proxy to vote your shares by telephone as described in your proxy card. If you authorize your proxy to vote your shares over the Internet, return your proxy card by mail or vote by telephone prior to the annual meeting,Annual Meeting, you may nevertheless revoke your proxy and cast your vote personally at the meeting.Annual Meeting.

We look forward to seeing you on May 9, 2018.appreciate your participation in our Annual Meeting.

Sincerely,

Jeffrey S. Olson

Chairman of the Board and Chief Executive Officer

TABLE OF CONTENTS

Urban Edge Properties

888 Seventh Avenue

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 9, 20181, 2024

To Our Shareholders:

You are cordially invited to attend the Annual Meeting of Shareholders (the “Annual Meeting”) of Urban Edge Properties, a Maryland real estate investment trust (“we”, or the “Company” or “UE”), to be held on Wednesday, May 9, 2018,1, 2024, at 9:00 a.m. Eastern Time, atTime. The Annual Meeting will be held entirely online. You can attend and participate in the officesAnnual Meeting online by visiting www.virtualshareholdermeeting.com/UE2024, where you will be able to listen to the Annual Meeting live, submit questions and vote. To join the Annual Meeting, you will need to have your 16-digit control number, which is included in the Notice (as defined below) and the proxy card sent to you or, if you are a beneficial owner who did not receive such number, may be obtained upon request to the broker, bank, or other nominee that holds your shares. Please see the “Questions and Answers” section of Goodwin Procter LLP, our definitive proxy statement in connection with the Annual Meeting, filed with the Securities and Exchange Commission on March 22, 2024 (the “Proxy Statement”), for more details regarding the logistics of the virtual Annual Meeting, including the ability of shareholders to submit questions, and technical details and support related to accessing the virtual platform for the Annual Meeting.

The New York Times Building, 620 Eighth Avenue, New York, NY 10018,Annual Meeting will be held for the following purposes:

| |

1.

| To elect the seveneight trustees named in the Proxy Statement, each to serve until our annual meeting of shareholders held in 20192025 and until their successors are duly elected and qualify; |

| |

2.

| To consider and vote on a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2018;the fiscal year ending December 31, 2024; |

| |

3.

| To consider and vote, on a non-binding advisory basis, on a resolution to approve the compensation of our named executive officers as described in the Proxy Statement; and |

4.

| To consider and vote on a proposal to approve the Urban Edge Properties 2024 Omnibus Share Plan; |

4.5.

| To transact such other business as may properly come before the Annual Meeting, including any adjournmentspostponements or postponementsadjournments thereof. |

We are furnishing proxy materials to you electronically, via the Internet, instead of mailing printed copies of those materials to each shareholder. We believe that this process expedites receipt of our proxy materials by shareholders, while lowering the costs and reducing the environmental impact of our Annual Meeting. We have provided a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record on March 12, 2018.4, 2024. The Notice contains instructions on how to access our Proxy Statement and annual report over the Internet and how to vote online. The Notice also includes instructions on how you can request and receive a paper copy of the Proxy Statement and annual report for thisthe Annual Meeting and future meetings of shareholders.

The Board of Trustees has fixed the close of business on March 12, 20184, 2024 as the record date for determining the shareholders entitled to notice of and to vote at our Annual Meeting. Only holders of record of our common shares of beneficial interest, par value $.01 per share (the “Common Shares”), as of the close of business on March 12, 20184, 2024 are entitled to notice of and to vote at the Annual Meeting and at any adjournment or postponement thereof.

The Board of Trustees appreciates and encourages your participation in the Annual Meeting. Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented. You may authorize your proxy to vote your shares over the Internet as described in the Notice. Alternatively, if you requested and received a paper copy of the proxy card by mail, please complete, date, sign and promptly return the proxy card in the self-addressed stamped envelope provided. You also may vote by telephone as described in your proxy card. If you vote your shares over the Internet, by mail or by telephone prior to the Annual Meeting, you may nevertheless revoke your proxy and cast your vote personally at the meeting, as described in the Proxy Statement. If you intend to attend

By Order of the meeting in person, you must bring with you appropriate identification, as further described in the Proxy Statement.Board of Trustees,

ROBERT C. MILTON III

EXECUTIVE VICE PRESIDENT, GENERAL COUNSEL AND SECRETARY

New York, New York

March 22, 2024

TABLE OF CONTENTS

TABLE OF CONTENTS

| | | | |

| | | | |

| | By Order of the Board of Trustees, | |

| | | | |

| | ROBERT C. MILTON III | |

| | | | |

| | EXECUTIVE VICE PRESIDENT, GENERAL COUNSEL AND SECRETARY |

| | | | |

New York, New York | | | | |

March 29, 2018 | | | | |

| | | | |

TABLE OF CONTENTS

|

| |

| Page |

QUESTIONS AND ANSWERS

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Communication with the Board of Trustees | | | |

| | | |

| |

COMPENSATION OF TRUSTEES | |

Stock Ownership Guidelines | | | |

| | | |

| |

EXECUTIVE OFFICERS | |

| |

| | | |

| |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | |

| |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

EXECUTIVE OFFICER | | | |

| | | |

2017 Summary Compensation Table | |

All Other Compensation Table | |

Grants of Plan-Based Awards in 20172023 | | | |

Shares or Units | | | |

Narrative to Summary Compensation Table | |

2017 Outstanding Equity Awards at 2023 Fiscal Year End | | | |

| | | |

| | | |

TABLE OF CONTENTS

| | | |

| | | |

| | | |

| |

COMPENSATION COMMITTEE REPORT | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

FINANCIAL STATEMENTS | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

TABLE OF CONTENTS

Urban Edge Properties

888 Seventh Avenue

New York, New York 10019

Why did I receive a Notice of Internet Availability of Proxy Materials?

As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement and our annual report available to our shareholders electronically via the Internet.Internet in connection with the solicitation of proxies by our Board of Trustees (the “Board”) for use at our Annual Meeting of Shareholders (the “Annual Meeting”) to be held online on Wednesday, May 1, 2024, at 9:00 a.m. Eastern Time. We provided a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders of record on March 12, 2018.4, 2024. If you received the Notice electronically, you will not receive a printed copy of the proxy materials in the mail. If you would like to receive a printed copy of our proxy materials, please follow the instructions for requesting printed materials contained in the Notice.

Urban Edge Properties (“we”, Our shareholders are invited to attend the “Company” or “UE”) has furnishedAnnual Meeting online and are requested to vote on the proposals described in this Proxy Statement. The approximate date on which this Proxy Statement and accompanying materials will be first sent and made available to you in connection withshareholders is March 22, 2024.

How do I attend the solicitation of proxies by our Board of Trustees (“Board”) for use at the 2018virtual Annual Meeting?

The Annual Meeting of Shareholders (the “Annual Meeting”) towill be held atentirely online. Shareholders of record as of March 4, 2024, will be able to attend and participate online by accessing www.virtualshareholdermeeting.com/UE2024 using the officeslog in instructions below. Even if you plan to attend the Annual Meeting online, we recommend that you also vote by proxy as described herein so that your vote will be counted if you decide not to attend the Annual Meeting.

Access to the Audio Webcast of Goodwin Procter LLP,the Annual Meeting. The New York Times Building, 620 Eighth Avenue, New York, NY 10018, on Wednesday, May 9, 2018,live audio webcast of the Annual Meeting will begin promptly at 9:00 a.m. Eastern Time. TheOnline access to the audio webcast will open approximately thirty minutes prior to the start of the Annual Meeting to allow time for you to log in and test the computer audio system. We encourage our shareholders to access the Annual Meeting prior to the start time.

Log in Instructions. To attend the Annual Meeting, log in at www.virtualshareholdermeeting.com/UE2024. Shareholders will need their unique 16-digit control number, which appears on the Notice and this Proxy Statement provide the informationproxy card sent to them. In the event that you needdo not have a control number, please contact your broker, bank, or other nominee as soon as possible and no later than April 30, 2024, so that you can be provided with a control number and gain access to know to vote by proxy or in person at the Annual Meeting. WeIf, for any reason, you are first sending this Proxy Statementunable to locate your control number, you will still be able to join the virtual Annual Meeting as a guest by accessing www.virtualshareholdermeeting.com/UE2024 and following the guest log-in instructions; you will not, however, be able to vote or ask questions.

Submitting Questions at the virtual Annual Meeting. As part of the Annual Meeting, we will hold a live question and answer session, during which we intend to answer questions submitted during the Annual Meeting that are pertinent to the Company and the accompanying materialsmeeting matters, as time permits. Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered once.

Technical Assistance. Beginning 30 minutes prior to the start of and during the Annual Meeting, we will have support team ready to assist shareholders with any technical difficulties they may have accessing or hearing the Annual Meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, call our support team which will be posted on www.virtualshareholdermeeting.com/UE2024.

Availability of live webcast to team members and other constituents. The live audio webcast will be available to not only our shareholders but also to other constituents. Such constituents will be able to attend the online platform for the Annual Meeting by accessing www.virtualshareholdermeeting.com/UE2024 and following the guest log-in instructions; they will not, however, be able to vote or about March 29, 2018.ask questions.

TABLE OF CONTENTS

What items will be voted on at the Annual Meeting?

Shareholders will vote on the following items at the Annual Meeting:

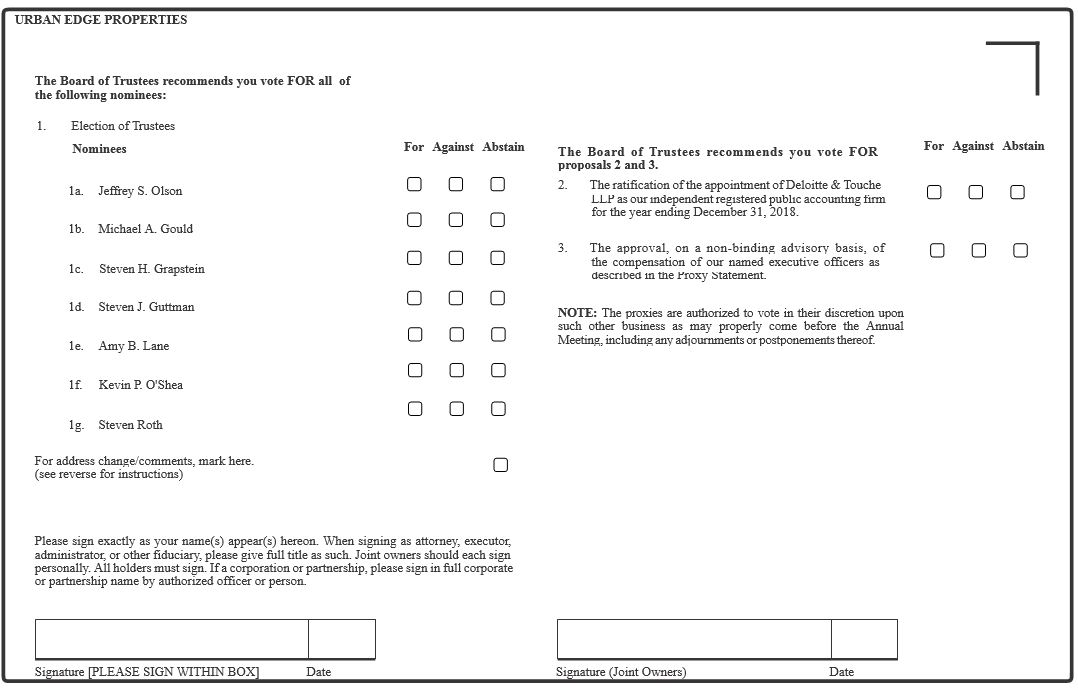

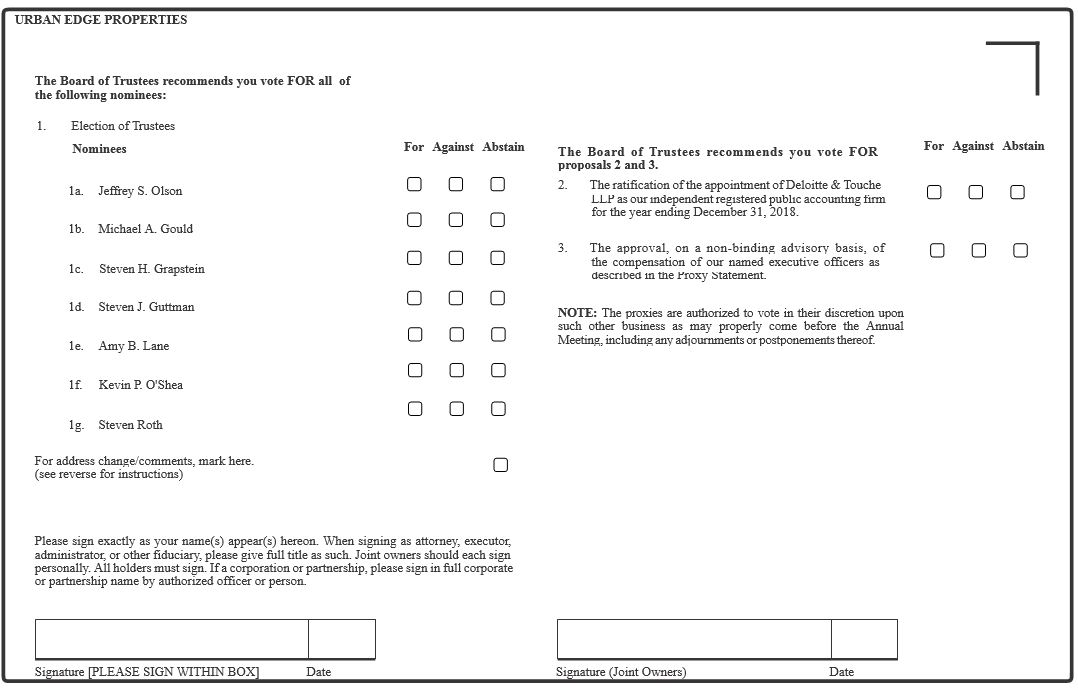

Proposal 1: the election of the seveneight trustees named in this Proxy Statement, each to serve until our annual meeting of shareholders held in 20192025 and until their successors are duly elected and qualify;

Proposal 2: the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2018; and2024;

Proposal 3: the approval, on a non-binding advisory basis, of the compensation of our named executive officers as described in this Proxy Statement.Statement; and

Proposal 4: the approval of the Urban Edge Properties 2024 Omnibus Share Plan.

In addition, shareholders will vote on such other business as may properly come before the Annual Meeting, including any adjournments or postponements thereof.

What is the Board’s voting recommendation for each item to be considered at the Annual Meeting?

The Board recommends that you vote your shares as follows:

Proposal 1: “FOR” the election of the seveneight trustee nominees named in this Proxy Statement;

Proposal 2: “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 2018; and2024;

Proposal 3: “FOR” the approval, on a non-binding, advisory basis, of the compensation of our named executive officers as described in this Proxy Statement.Statement; and

Proposal 4: “FOR” the approval of the Urban Edge Properties 2024 Omnibus Share Plan.

What vote is required to approve the proposals?

Once a quorum is present, the following vote is required to approve each proposal:

Proposals 1, 2 and 3: The electionProposal 1: Each trustee nominee shall be elected by the affirmative vote of a majority of the votes cast with respect to that trustee nominee, thenominee’s election.

Proposals 2, 3 and 4: The ratification of the appointment of Deloitte & Touche LLP, and the non-binding advisory approval of the compensation of our named executive officers, and the approval of the Urban Edge Properties 2024 Omnibus Share Plan must each be approved by the affirmative vote of a majority of the votes cast on theeach proposal.

Other Items: A majority of the votes cast will be sufficient to approve any other matter which may properly come before the Annual Meeting. The Board does not currently know of any other matters that may properly be brought before the Annual Meeting.

What is the quorum for the meeting?Annual Meeting?

The presence in persononline or by proxy of shareholders entitled to cast a majority of all the votes entitled to be cast at the Annual Meeting will constitute a quorum to transact business at the Annual Meeting. At the close of business on the record date, March 4, 2024, there were 118,787,400 common shares of beneficial interest (the “Common Shares”) issued and outstanding. Your shares will be counted for purposes of determining if there is a quorum, whether representing votes for, against or abstained, if you:

Are present and vote in person online at the Annual Meeting; or

Have authorized a proxy on the Internet, by telephone or by properly submitting a proxy card or vote instruction form by mail.

If a quorum is not present at the Annual Meeting, the chairman of the meeting may adjourn the Annual Meeting sine die or from time to time to a date not more than 120 days after the original record date of March 12, 20184, 2024 without notice other than announcement at the meeting.Annual Meeting.

TABLE OF CONTENTS

Who is entitled to attend and vote at the Annual Meeting?

All shareholders of record as of the close of business on March 12, 2018, the record date for the Annual Meeting are entitled to receive notice of, attend and vote at the Annual Meeting. You may authorize a proxy to vote your shares without attending the Annual Meeting. You are entitled to cast one vote for each whole common share of beneficial interest, par value $.01 per share (a “Common Share”),Common Share you held of record as of the record date. As of the record date, there were 113,920,633 shares of our Common Shares issued and outstanding.

AttendanceVoting at the Annual Meeting is limited to shareholders. In ordershareholders of record and beneficial owners of our Common Shares (see the following question for the relevant distinction). Beneficial owners are invited to attend the Annual Meeting in person, each shareholderonline at www.virtualshareholdermeeting.com/UE2024 and may use their 16-digit control number to vote their shares. Non-shareholder constituents will be required to present valid U.S. federal or state government issued picture identification, such as a driver’s license or passport, to confirm share ownership as of the record date. Beneficial owners will also be required to present proof of beneficial ownership, such as a vote instruction form or brokerage statement, to be admitted to the meeting. The use of cell phones, smartphones, pagers, recording and photographic equipment and/or computers is not permitted in the meeting room at the Annual Meeting.

Directionsable to attend the online platform for the Annual Meeting by accessing www.virtualshareholdermeeting.com/UE2024 and following the guest log-in instructions; they will not, however, be able to vote in person are available at our website at www.uedge.com.or ask questions.

What is the difference between a shareholder of record and a beneficial owner?

Shareholder of Record. If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC (“AST”), you are considered the shareholder of record with respect to those shares, andshares. In such case, the Notice, and if requested, the proxy materials, were sent directly to you by AST.

Beneficial Owner of Shares Held in Street Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,name.” andIn such case, the Notice, and if requested, the proxy materials, will be forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to instruct that organization on how to vote the shares held in your account. Those instructions are contained in a “vote instruction form” provided to you by the organization that holds your shares. As a beneficial owner, you are also invited to attend the Annual Meeting online at www.virtualshareholdermeeting.com/UE2024 and you may use your 16-digit control number to vote your shares.

If I am a shareholder of record, how do I vote?

Whether or not you plan to attend the Annual Meeting, we urge you to authorize your proxy to vote your shares. As described in the Notice, there are four ways to vote:

Via the Internet. You may authorize a proxy via the Internet by visiting www.proxyvote.com and entering the control number found on the Notice.

By Telephone. If you received your proxy materials by mail, you may authorize a proxy by calling the toll free number found on the proxy card.

By Mail. If you received your proxy materials by mail, you may authorize a proxy by filling out the proxy card and sending it back in the envelope provided.

In Person. You may vote in person at the Annual Meeting. We will give you a ballot when you arrive at the Annual Meeting.

| • | Via the Internet. You may authorize a proxy to vote your shares via the Internet by visiting www.proxyvote.com and entering the control number found on the Notice and the proxy card; |

| • | By Telephone. If you received your proxy materials by mail, you may authorize a proxy to vote your shares by calling the toll free number found on the proxy card; |

| • | By Mail. If you received your proxy materials by mail, you may authorize a proxy to vote your shares by filling out the proxy card and sending it back in the envelope provided; or |

| • | Online. You may vote online by attending the Annual Meeting online and following the instructions posted at www.virtualshareholdermeeting.com/UE2024. |

Telephone and internetInternet authorization methods for shareholders of record will be available until 11:59 p.m. (Eastern Time) on May 8, 2018.April 30, 2024. If you voteauthorize a proxy by mail to vote your shares, you must ensure proper completion and receipt of the proxy no later than May 8, 2018.April 30, 2024.

If I am a beneficial owner of shares held in street name, how do I vote?

If you own shares held by a broker, bank or other nominee organization you may instruct your broker to vote your shares in the manner that you direct by following the instructions that the broker provides to you. IfAs a beneficial owner, you are also invited to attend the beneficial owner of sharesAnnual Meeting online at www.virtualshareholdermeeting.com/UE2024 and you may use your 16-digit control number to vote your shares. If your Common Shares are held in streetthe name of your broker, bank or other nominee organization, and you wishwant to vote in person, at the Annual Meeting, you mustwill need to obtain a legal proxy from the organizationinstitution that holds your shares prior to the Annual Meeting. Please contact that organization for instructions on how to obtain a legal proxy.Common Shares.

TABLE OF CONTENTS

Can I change or revoke my proxy?

Yes. If you are a shareholder of record, you may revoke your proxy at any time prior to its exercise by filing with our Secretary a duly executed revocation of proxy, by properly submitting, either by Internet, mail or telephone, a proxy bearing a later date or by appearingattending the Annual Meeting and voting online. Attendance online at the meeting and voting in person. Attendance at the meetingAnnual Meeting will not by itself constitute revocation of a proxy. If you are the beneficial owner of shares held in street name, you must contact the organization that holds your shares to receive instructions as to how you may revoke your voting instructions.

How are proxies voted?

Proxies properly submitted via the Internet, mail or telephone will be voted at the Annual Meeting in accordance with your directions. If your properly-submitted proxy does not provide voting instructions on a proposal, then the proxy holders will vote your shares (i) in the manner recommended by the Board on all matters presented in this Proxy Statement and (ii) as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting. Mark J. Langer, Robert C. Milton III and Alexandra FerroneGenevieve Kelly have been designated as proxy holders for the Annual Meeting.

How are abstentions and broker non-votes treated?

If you are a beneficial owner whose shares are held of record by a bank, broker, or other similar nominee organization in street name, you must instruct the broker how to vote your shares. A “broker non-vote” occurs whenat a meeting at which there is at least one “routine” proposal on which brokers are permitted to vote, and a bank, broker or other holder of recordnominee organization holding shares for a beneficial owner does not vote on a particular proposal because thatit is a non-routine proposal and the holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Under the rules of the New York Stock Exchange (the “NYSE”), the only routine item to be acted upon at the Annual Meeting with respect to which a broker or nominee will be permitted to exercise voting discretion is the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Therefore, if you hold your Common Shares in street name and you do not give the broker or nominee specific voting instructions on the election of the trustees, the advisory resolution to approve the compensation of our named executive officers or the approval of the Urban Edge Properties 2024 Omnibus Share Plan, your shares will not be voted on those items, and a broker non-vote will occur.

You may choose to abstain or refrain from voting your shares on one or more issues presented for a vote at the Annual Meeting. However, both abstentionsAbstentions and broker non-votes are counted as present for purposes of determining the presence of a quorum. Abstentions and broker non-votes are not considered votes cast and therefore will not affect the outcome of the vote on any of the proposals.

Who has paid for this proxy solicitation?

We have paid the entire expense of preparing, printing and mailing the Notice and, to the extent requested by our shareholders, the proxy materials and any additional materials furnished to shareholders. We have requested banks, brokers or other nominees and fiduciaries to forward the proxy materials to beneficial owners of our Common Shares and to obtain authorization for the execution of proxies. We will reimburse such parties for their reasonable expenses in forwarding proxy materials to beneficial owners upon request.

Proxies may be solicited by our trustees, officers or employees personally or by telephone without additional compensation for such activities. No arrangements or contracts have been made with any solicitors as of the date of this Proxy Statement, although we reserve the right to engage solicitors if we deem them necessary. Such solicitations may be made by mail, telephone, facsimile, e-mail or personal interviews.

Where can I find additional information?

OurPlease refer to our website, which is located at www.uedge.com. Although the information contained on or connected toavailable through our website is not part of this Proxy Statement, you can view additional information on the website, such as the charters of our Audit Committee, Compensation Committeecorporate governance materials and Corporate Governance and Nominating Committee, our Corporate Governance Guidelines, our Code of Business Conduct and Ethics, and reports that we file with the SEC.SEC filings. Copies of these documents may be obtained free of charge by writing to Urban Edge Properties, 888 Seventh Avenue, New York, New York 10019, Attention: Robert C. Milton III, Executive Vice President, General Counsel and Secretary.

PROPOSAL 1

CONTENTSCurrent Board of Trustees

Our Board of Trustees (“Board”) currently consists of sevennine trustees (“Trustees”(together the “Trustees”, and each a “Trustee”). Commencing this year, eachEach Trustee will beis elected annually for a term of one year and shall holdholds office until the next succeeding annual meeting and until a successor is duly elected and qualifies. Under our Bylaws, at a shareholder meeting to elect Trustees, the affirmative vote of a majority of the votes cast with respect to a nominee's election is sufficient to elect a Trustee (as long as a quorum is present), unless the election is contested, in which case a plurality of all votes cast will be sufficient.

The following table sets forth the name, age, starting year and position for each of our current Trustees as of the date of this Proxy Statement, including the eight Trustee nominees for election at the Annual Meeting:

Jeffrey S. Olson | | | 56 | | | 2014 | | | Trustee (Chairman) and Chief Executive Officer |

Mary L. Baglivo | | | 66 | | | 2022 | | | Independent Trustee |

Steven H. Grapstein | | | 66 | | | 2015 | | | Independent Trustee |

Steven J. Guttman(1) | | | 77 | | | 2015 | | | Independent Trustee |

Norman K. Jenkins | | | 61 | | | 2021 | | | Lead Independent Trustee |

Kevin P. O'Shea | | | 58 | | | 2014 | | | Independent Trustee |

Catherine D. Rice | | | 64 | | | 2023 | | | Independent Trustee |

Katherine M. Sandstrom | | | 55 | | | 2022 | | | Independent Trustee |

Douglas W. Sesler | | | 62 | | | 2020 | | | Independent Trustee |

(1)

| Not up for re-election at the Annual Meeting. Following the Annual Meeting, our Board size will be reduced from nine to eight Trustees. |

TABLE OF CONTENTS

PROPOSAL 1 ELECTION OF TRUSTEES

In evaluating the suitability of individual Board members,trustee nominees, our Corporate Governance and Nominating Committee takes into account many factors such as general understanding of various business disciplines (e.g., marketing or finance), understanding of the Company’s business environment, educational and professional background, judgment, integrity, diversity, ability to make independent analytical inquiries and willingness to devote adequate time to Board duties. The Board evaluates each individual in the context of the Board as a whole with the objective of retaining a group with diverse and relevant experience that can best perpetuate the Company’s success and represent shareholder interests through sound judgment.

The following table sets forth the name, age, starting year and position for each of our current Trustees as of March 12, 2018.

|

| | | | | | |

| Name | | Age | | Trustee Since | | Position |

| Jeffrey S. Olson | | 50 | | 2014 | | Trustee (Chairman) and Chief Executive Officer |

| Michael A. Gould | | 75 | | 2015 | | Trustee (Lead Trustee) |

| Steven H. Grapstein | | 60 | | 2015 | | Trustee |

| Steven J. Guttman | | 71 | | 2015 | | Trustee |

| Amy B. Lane | | 65 | | 2015 | | Trustee |

| Kevin P. O'Shea | | 52 | | 2014 | | Trustee |

| Steven Roth | | 76 | | 2015 | | Trustee |

Nominees for Election to Term Expiring 2019

2025

Jeffrey S. Olson, Michael A. Gould,Mary L. Baglivo, Steven H. Grapstein, Steven J. Guttman, Amy B. Lane,Norman K. Jenkins, Kevin P. O'Shea, Catherine D. Rice, Katherine M. Sandstrom and Steven RothDouglas W. Sesler have been nominated to serve on the Board until our 20192025 annual meeting of shareholders and until their respective successors are duly elected and qualify. The Board has no reason to believe that Messrs. Olson, Gould, Grapstein, Guttman, O'Shea or Roth or Mdme. Laneany such nominees will be unable, or will decline, to serve if elected. TrusteesEach Trustee nominee will be elected by the affirmative vote of a majority of the votes cast with respect to that Trustee’s election.

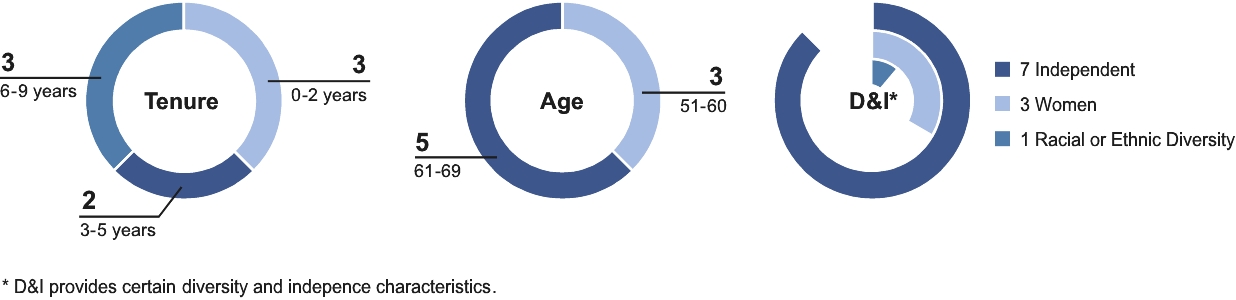

Below is an overview of some key attributes of our eight nominees to the Board. Further information on each nominee’s qualifications and relevant experience is provided in the election of Trustees.individual biographies included in this Proxy Statement.

TABLE OF CONTENTS

The biographical descriptions below set forth certain information with respect to each nominee for election as a Trustee at the Annual Meeting as of March 12, 2018.Meeting. The Board has identified specific attributes of each nominee that the Board has determined qualify that person for service on the Board.

|

| | |

Jeffrey S. Olson

Chairman and Chief Executive Officer

Trustee Since: 2014

Age: 56 | | | Jeffrey S. Olson has served as our Chairman and Chief Executive Officer since December 29, 2014 and has served as a Trustee since December 19, 2014. Mr. Olson served as chief executive officer and a member of the board of directors of Equity One, Inc. (“Equity One”) from 2006 until September 1, 2014, at which time Mr. Olson joined Vornado Realty Trust (NYSE: VNO) (“Vornado”) in order to work on the separation of the Company from Vornado. From 2006-2008, Mr. Olson also served as the president of Equity One. Prior to joining Equity One, he served as president of the Eastern and Western Regions of Kimco Realty Corporation (NYSE: KIM) from 2002 to 2006. Mr. Olson has areceived an M.S. in Real Estate from The Johns Hopkins University and a B.S. in Accounting from the University of Maryland, and was previously a Certified Public Accountant.certified public accountant.

Mr. Olson’s qualifications to serve on our Board include his role as our Chief Executive Officer, his experience as chief executive officer and a board member of Equity One and general expertise in real estate operations, as well as his knowledge of the REITreal estate investment trust (“REIT”) industry developed as an analyst covering many U.S. REITs. Mr. Olson currently serves as an Executivea Board Member of the National Association of Real Estate Investment Trusts ("NAREIT"(“Nareit”).

|

Chairman and Chief Executive Officer | |

| |

Mary L. Baglivo

Trustee

Trustee Since: 20142022

Age: 66 | |

Age: 50 | |

| |

| |

| |

| |

| |

| |

| | |

Michael A. Gould | | Michael A. GouldMary L. Baglivo has served as a Trustee since January 14, 2015. Mr. Gould served as ChairmanSeptember 1, 2022. Ms. Baglivo is a highly accomplished marketing and CEO of Bloomingdale’s, a division of Macy’s Inc., a major retailer operating department stores and specialty stores, from 1991 to 2014. Prior to joining Bloomingdale’s, Mr. Gould was the President and Chief Operating Officer of Giorgio Beverly Hills beginningcommunications executive, with extensive experience in 1986 and became its President andglobal marketing firm Chief Executive Officer in 1987. Mr. Gould also worked at J.W. Robinson’s Department Stores in Los Angeles from 1978 to 1986, servingroles, as its Chairman andwell as higher education Chief Marketing Officer positions. Ms. Baglivo currently serves as the Chief Executive Officer from 1981 to 1986. Since November 2015, Mr. Gould has servedof the Baglivo Group, a strategy consulting company. She is also currently a director at Host Hotels and Resorts (NASDAQ: HST), the largest hotel real estate investment trust, where she serves as Chair of the Culture and Compensation Committee and is a member of the Nominating, Governance and Corporate Responsibility Committee, and a director at Ollie’s Bargain Outlet Holdings, Inc. (NASDAQ: OLLI), where she also serves on the BoardNominating and Corporate Governance Committee. Ms. Baglivo's prior board experience includes PVH Corp. (NYSE: PVH) (Calvin Klein, Tommy Hilfiger), where she was actively engaged in the company's transformational growth via acquisitions and omni-channel innovation and Ruth’s Chris Hospitality Group (formerly, NASDAQ: RUTH) where she served as director from 2017 until its privatization in June of Directors2023. She is actively involved in environmental, social and governance (“ESG”) initiatives, as a member of David Yurman, a leading fine jewelryCorporate Responsibility Committees of Host Hotels and luxury timepiece retailer with over 360 locations worldwide. Mr. Gould received his B.A. from Columbia College in 1966Resorts and his M.B.A. from Columbia Business School in 1968.Ruth’s Hospitality Group.

Mr. Gould’sMs. Baglivo’s qualifications to serve on our Board include hisher extensive knowledge ofleadership and marketing experience and her director roles and committee involvement in both the hospitality and retail sector and management experience at multiple companies.industries.

|

TABLE OF CONTENTS

Steven H. GrapsteinTrustee | |

| |

Trustee Since: 2015

Age: 66 | |

Age: 75 | |

| |

| |

| |

| | |

Steven H. Grapstein | | Steven H. Grapstein has served as a Trustee since January 14, 2015. Mr. Grapstein has been Chief Executive Officer of Como Holdings USA, Inc., an international investment group, since January 1997. From September 1985 to January 1997, Mr. Grapstein was a Vice President of Como Holdings USA, Inc. Since November 2015, Mr. Grapstein has served on the Board of Directors of David Yurman, a leading fine jewelry and luxury timepiece retailer with over 360 locations worldwide. Since November 2003, Mr. Grapstein has served on the Board of Directors of Mulberry Plc, a UK listed company that wholesales and retails luxury leather goods in over 30 countries. Mr. Grapstein also held the position of Chairman of Presidio International dba A/X Armani Exchange, a fashion retail company from 1999 to June 2014. Mr. Grapstein served as Chairman of Tesoro Corporation (NYSE: TSO) from 2010 through 2014 and served on its board from 1992 through May 2015. Mr. Grapstein holdsreceived a B.S. in Accounting from Brooklyn College (1979) and is a Certified Public Accountantcertified public accountant (1981). He is also a director of several privately held hotel and real estate entities.

Mr. Grapstein’s qualifications to serve on our Board include his broad experience in the real estate and retail sectors across a variety of companies, as well as the knowledge of board responsibilities and mechanics he brings from his experience as a former Chairman of a Fortune 100 public company and service on multiple board committees.

|

Norman K. Jenkins Trustee | |

| |

Trustee Since: 20152021

Age: 61 | |

Age: 60 | |

| |

| |

| |

| |

| |

| |

| |

|

| | |

| | |

Steven J. Guttman | | Steven J. GuttmanNorman K. Jenkins has served as a Trustee since January 14, 2015.November 22, 2021. Mr. Guttman isJenkins brings over 25 years of real estate and executive leadership experience. In 2009, he founded Capstone Development, LLC, a real estate industry veterancompany focused on the acquisition and development of institutional-quality lodging assets affiliated with over 40 years of experience. In January of 2013, Mr. Guttman founded UOVO Fine Art Storage, which is developing next generation, high-tech facilities for fine art storage, andtop-tier national lodging brands, where he currently serves as UOVO’s Chairman. Prior to founding UOVO, Mr. Guttman had a 30-year career with the Federal Realty Investment Trust, becoming managing Trustee in 1979, President, Chief Executive Officer and TrusteeManaging Partner. Prior to that, Mr. Jenkins spent 16 years with Marriot International, Inc. (NASDAQ: MAR), serving in 1980,several leadership positions before being named Senior Vice President of North American Lodging Development. Mr. Jenkins was the architect of Marriott’s industry-leading Diversity Ownership Initiative which was responsible for doubling the number of diverse-owned Marriott hotels over a three-year period to 500 hotels. Mr. Jenkins also serves on the board of directors of AutoNation, Inc. (NYSE: AN) and Chairman ofserved on the Board and Chief Executive Officerof Directors of Duke Realty (formerly NYSE: DRE) from August 2017 through its acquisition by Prologis, Inc. in February 2001, the position he held at the time of retirement in 2003. In 1998, Mr. Guttman founded Storage Deluxe Management Company, a Manhattan-based owner, developer and manager of self-storage facilities, of which heOctober 2022. He is the principal investor. In the last 15 years, Storage Deluxe has developed approximately 40 properties with in excess of 4 million square feet, primarily in the New York City metropolitan area. Mr. Guttman has been a member of the National Association of Real Estate Investment Trusts ("NAREIT") since 1973Washington, DC Developer Roundtable and served asis a former member of the Howard University Board of Governors and Executive Committee, including as Chairman of the Board of GovernorsTrustees. Mr. Jenkins earned a BA in Accounting from 1997-1998. He received a B.A. from theHoward University, of Pittsburgh in 1968, and received a J.D.an MBA from George Washington University in 1972.and is a certified public accountant.

Mr. Guttman’sJenkins' qualifications to serve on our Board include his extensive careersenior leadership experience at a large,premier national lodging brand and other institutions, his extensive public company board experience and entrepreneurial success in founding a successful retail REIT (culminating with his service as Chief Executive Officerreal estate company focused on the acquisition and Chairmandevelopment of the Board), and his experience in the REIT industry generally, including his participation in NAREIT.

lodging assets.

|

TABLE OF CONTENTS

Trustee | |

| |

Trustee Since: 2015 | |

Age: 71 | |

| |

| |

| |

| |

| |

| |

| |

| | |

Amy B. Lane | | Amy B. Lane has served as a Trustee since January 14, 2015. Ms. Lane was an investment banker for 26 years, primarily specializing in the retail and apparel industry during that time. From 1997 until her retirement in 2002, Ms. Lane served as a Managing Director and Group Leader of the Global Retailing Investment Banking Group at Merrill Lynch & Co., Inc. Before working at Merrill Lynch, Ms. Lane founded and led the retail industry investment banking unit at Salomon Brothers, Inc., having joined that firm in 1989. Ms. Lane began her investment banking career at Morgan Stanley & Co. in 1977. Ms. Lane is currently a director of The TJX Companies, Inc., GNC Holdings, Inc. and NextEra Energy, Inc. Ms. Lane received an M.B.A. in Finance from The Wharton School and a B.S. degree from the University of Pennsylvania.

Ms. Lane’s qualifications to serve on our Board include her extensive experience in the retail and apparel sectors, as well as her financial expertise from her many years in investment banking.

|

Trustee | |

| |

Trustee Since: 2015 | |

Age: 65 | |

| |

| |

| |

| |

| |

| | |

Kevin P. O'Shea

Trustee

Trustee Since: 2014

Age: 58 | | | Kevin P. O’Shea has served as a Trustee since December 29, 2014. Mr. O’Shea has been the Chief Financial Officer of AvalonBay Communities, Inc. (NYSE: AVB), a multifamily real estate investment trust, since May 31, 2014.2014 (“AvalonBay”). Previously, he had served as Executive Vice President-Capital Markets and as Senior Vice President-Investment Management at AvalonBay. Mr. O’Shea joined AvalonBay in July 2003. Prior to that time, Mr. O’Shea was an Executive Director at UBS Investment Bank, where his experience included real estate investment banking. Earlier in his career, Mr. O’Shea practiced commercial real estate and banking law as an attorney. Mr. O’Shea received hisan M.B.A. from Harvard Business School, hisa J.D. from Southern Methodist University and his undergraduate degreea B.A. from Boston College.

Mr. O’Shea’s qualifications to serve on our Board include his education and experience in business and legal roles, his extensive experience in the REIT sector and his financial expertise stemming from his experience as the Chief Financial Officer of a major REIT, and his experience in the real estate investment banking sector.

|

Catherine D. Rice Trustee | |

| |

Trustee Since: 20142023

Age: 64 | |

Age: 52 | |

| |

| |

| |

| | |

|

| | |

Steve Roth | | Steven RothCatherine D. Rice has served as a Trustee since March 15, 2023. Ms. Rice served as the Senior Managing Director and Chief Financial Officer from January 14, 2015. Mr. Roth2013 to February 2016 of W.P. Carey (NYSE: WPC). Before joining W.P. Carey in 2013, Ms. Rice was a partner at Parmenter Realty Partners from January 2010 until December 2012 and a Senior Advisor and Board Member for CTS Cement Manufacturing Co. from April 2009 to January 2019. Ms. Rice spent the first 16 years of her career as a professional in the real estate investment banking groups of Merrill Lynch, Lehman Brothers and Banc of America Securities. Ms. Rice has over 30 years of experience in the public and private capital markets and has been involved in over $50 billion of capital-raising and financial advisory transactions, including numerous REIT IPOs, public and private debt and equity offerings, mortgage financings, merger and acquisition assignments, leveraged buyouts, asset dispositions and debt restructurings. Ms. Rice serves on the Chairmanboards of BrightSpire Capital (NYSE: BRSP), a REIT, since 2018, and RMG Acquisition Corp III (NASQ: RMGCU) since 2021. At BrightSpire she also serves as a member of the Audit Committee. She served as an independent director of Store Capital (NYSE: STOR), a net-lease REIT, from 2017 until its privatization in early 2023.

Ms. Rice's qualifications to serve on our Board include her extensive experience in real estate investment banking, finance, as well as her extensive executive leadership experience. |

TABLE OF CONTENTS

Katherine M. Sandstrom Trustee

Trustee Since: 2022

Age: 55 | | | Katherine M. Sandstrom has served as a Trustee since October 1, 2022. Ms. Sandstrom brings deep experience in real estate investment including more than twenty years of service at Heitman, LLC, a real estate investment management firm, where she held a variety of senior leadership positions including her roles as Senior Managing Director and global head of Heitman’s Public Real Estate Securities business from 2013 to 2018. Ms. Sandstrom oversaw the growth of assets under management to more than $5 billion invested in domestic and global funds, as well as separately managed accounts. Additionally, Ms. Sandstrom served on Heitman’s Global Management Committee, the Board of TrusteesManagers and the Allocation Committee. Ms. Sandstrom has served on the Board of Vornado,EastGroup Properties, Inc. (NYSE: EGP), a real estate investment trust, since May 19892020, Healthpeak Properties, Inc. (NYSE: PEAK) since 2018, and ChairmanToll Brothers, Inc. (NYSE: TOL) since 2023. She serves as an Audit committee member and the Chair of the ExecutiveNominating and Corporate Governance Committee at EGP. At PEAK, she serves as Chair of the Board, Chair of Trusteesthe Nominating and Corporate Governance Committee and a member of Vornado since April 1980. From May 1989 until May 2009, Mr. Roththe Compensation & Human Capital Committees.

Ms. Sandstrom's qualifications to serve on our Board include her extensive experience in the real estate investment, capital markets, and executive leadership. |

Douglas W. Sesler Trustee

Trustee Since: 2020

Age: 62 | | | Douglas W. Sesler has served as Vornado’s Chief Executive Officer, and has been servinga Trustee since March 20, 2020. Most recently, Mr. Sesler served as Chief Executive Officer againthe Head of Real Estate for Macy's, Inc. (NYSE: M), a position he held from April 15, 2013 until the present. Since 1968,2016 to April 2021. From 2011 to 2016, Mr. Sesler was president of True Square Capital LLC, a real estate investment and advisory firm. From 2005 to 2011, he has beenwas employed at Bank of America Merrill Lynch International Ltd. in roles that included global head of principal real estate investments and global co-head of real estate investment banking. From 1989 to 2005, Mr. Sesler served in a general partnervariety of Interstate Propertiesroles at Citigroup and he currently servesits predecessors, including as its Managing General Partner. He is the Chairmanmanaging director of the Boardglobal real estate investment banking group and Chief Executive Officer of Alexander’s, Inc. and the Chairmanmanaging director of the BoardTravelers Realty Investment Company. He began his career in real estate roles at Chemical Bank. Mr. Sesler served on the board of JBG Smith Properties.directors of Gazit Globe Ltd., an international owner, developer and operator of shopping centers from January 2012 to November 2020. Mr. Roth wasSesler received a director of J.C. Penney Company, Inc. (a retailer)B.A. in Government from 2011 until September 13, 2013.Cornell University.

Mr. Roth’sSesler's qualifications to serve on our Board include his experience in leadership and board responsibilities for a major REIT (as well as with other significant real estate companies), his deep understanding of the class of assets held by the Company and his many years ofextensive experience in the real estate field generally.sector, including in an executive position with one of the largest U.S. department store companies, as well as his experience in the real estate investment banking sector. |

Trustee | |

| |

Trustee Since: 2015 | |

Age: 76 | |

| |

| |

| |

| |

| THE BOARD OF TRUSTEES RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES. |

THE BOARD

CONTENTS

CORPORATE GOVERNANCE AND RELATED MATTERS

Board Leadership Structure

Our Board is deeply focused on oureffective corporate governance practices. Our current leadership structure is comprised of a combined Chairman of the Board and Chief Executive Officer, a Lead Trustee who is independent and Board committees comprised solely of independent Trustees. The Board believes its current structure provides an effective balance between strong Company leadership and appropriate safeguards and oversight by independent Trustees. We value independent board oversight as an essential component of strong corporate performance to enhance shareholder value. All of our Trustees are independent, except Jeffrey S. Olson, our Chairman and Chief Executive Officer and Mr. Roth.Officer.

As Chairman and Chief Executive Officer, Mr. Olson uses the in-depth focus and perspective gained as a senior executive leadingthrough his leadership at the Company and at other real estate companies, and as an analyst covering many U.S. REITs to effectively and efficiently guide our Board. He fulfills his responsibilities through close interaction with our Lead Trustee Michael A. Gould, who wasis elected annually to serve in that capacity by the independent Trustees of our Board.

The Board concluded that Mr. Olson, as a well-seasoned leader with a track record of running and analyzing real estate companies over a long period of time, is the best person to lead the Board. The Board also considered current Board relationships and determined that there is actual and effective independent oversight of management with Mr. Gould serving as independenta result of, among other factors, (i) the appointment of a Lead Trustee, providingwho provides significant independent oversight of the Board, and with(ii) all members of the Board, as a whole,other than Mr. Olson, being primarily comprised of members independent of management, also serving as an actual and effective independent voice.independent.

Trustee Independence

Our Corporate Governance Guidelines and the NYSE listing standards require that at least a majority of our Trustees, and all of the members of the Audit, Compensation and Corporate Governance and Nominating Committees, be “independent.” The“independent”. NYSE listing standards provide that, to qualify as an “independent”, a Trustee, in addition to satisfying certain bright-line criteria, must be affirmatively determined by the Board must affirmatively determine that a Trustee has nonot to have any material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company).

In addition, our Board has adopted categorical standards to assist it in making determinations of independence. These categorical standards specify certain relationships that our Board has determined not to be material relationships that would categorically impair a Trustee’s ability to qualify as independent, including, among others, (i) a Trustee’s or his or her immediate family member’s status as an employee of an organization that has made payments to the Company, or that has received payments from the Company, not in excess of certain specified amounts; (ii) beneficial ownership by a Trustee or his or her immediate family member of not more than 10% of the Company’s equity securities or where a Trustee or his or her immediate family member holds certain positions with an organization that beneficially owns not more than 10% of the Company’s equity securities; (iii) relationships with organizations with which the Company conducts business, in each case, which owe money to the Company or to which the Company owes money not in excess of certain specified amounts; (iii)(iv) personal relationships between a Trustee (or a member of the Trustee’s immediate family) with a member of the Company’s management; and (iv)(v) any other relationship or transaction that is not covered by any of the categorical standards that does not involve the payment of more than $100,000 in the most recently completed fiscal year of the Company. The Board of Trustees’ categorical standards are set forth in our Corporate Governance Guidelines on the Company’s website located at www.uedge.com. The information contained on or available through our website is not part of this Proxy Statement.

In accordance with these categorical standards and the NYSE listing standards, the Board

undertook its annual review of the independence of our Trustees at the meetings of the Corporate Governance and Nominating Committee on February 22, 2018 and of the Board of Trustees on February 23, 2018. During these reviews, the Board considered relationships between each Trustee or members of his or her immediate family and the Company, and whether there were transactions between the Trustees or members of their immediate families and the Company. The Board affirmatively determined that each of our Trustees, other than

Messrs.Mr. Olson,

and Roth, satisfies the bright-line independence criteria of the NYSE and that none has a relationship with us that would interfere with such person’s ability to exercise independent judgment as a member of the Board. In

determining that Ms. Lane qualified as an independent director for purposes of her service on the Board and the committees on which she serves,making this determination, the Board considered

her membership on the

board of directors of The TJX Companies, Inc., which is one of our largest tenants. The Board’s conclusion that this relationship did not impair Ms. Lane’s independence for purposes of her service on the Compensation Committee was primarily based on the fact that Ms. Lane serves as an independent, non-employee director of The TJX Companies, Inc., which is a relationship that is deemed immaterial pursuant to the categorical standards adopted by the Board. Therefore, we believe that all of these Trustees, who constitute a majority of the Board, are independentrelationships described under the

NYSE rules.caption “Certain Relationships and Related Transactions” beginning on page 69.TABLE OF CONTENTS

Our Corporate Governance Guidelines provide that a Lead Trustee shall annuallymust be elected by a majority of the independent Trustees. Mr. Michael A. Gould has servedTrustees annually (typically, in May of each year). Norman K. Jenkins was elected by our independent Trustees to serve as our Lead Trustee since 2015.effective September 1, 2022. The responsibilities and goals of our Lead Trustee are described in our Corporate Governance Guidelines and include the following:

Serving as a resource to the Chairman/CEO and to the other independent Trustees, coordinating the activities of the independent Trustees;

Chairing all Board meetings at which the Chairman is not present, including executive sessions and meetings of the independent Trustees;

Consulting with the Chairman to suggest the schedule of Board meetings and annual or special meetings of shareholders;

Providing input to the Chairman to determine agendas for Board meetings;

Chairing all executive sessions of the Board and meetings of the independent Trustees;

Serving as a liaison between the Chairman/Chief Executive Officer and the independent Trustees;

Coordinating with the independent Trustees to evaluate the Chairman/Chief Executive Officer's performance in relation to annual goals and objectives;

Helping to develop a high-performing Board, by assisting Trustees in reaching consensus, keeping the Board focused on strategic decisions, managing information flow between the Trustees and management and coordinating activities across various committees; and

Supporting effective shareholder communication by the Chairman/Chief Executive Officer and the Board.

Corporate Governance Guidelines

Our Board has adopted a set of Corporate Governance Guidelines to assist it in guiding our governance practices. The Corporate Governance Guidelines are re-evaluated at least annually by the Corporate Governance and Nominating Committee in light of changing circumstances in order to continue serving our best interests and the best interests of our shareholders.the Company. Our Corporate Governance Guidelines are available on our websiteat www.uedge.com under “About Us - Governance - Corporate Governance Guidelines” at www.uedge.com,, or by requesting a copy in print, without charge, by contacting our Secretary at 888 Seventh Avenue, New York, New York 10019. The information contained on or available through our website is not part of this Proxy Statement.

Our Trustees stay informed about our business by attending meetings of the Board and its committees and through supplemental reports and communications.

Board Committees

Our Board has established standing committees to assist it in the discharge of its responsibilities. The principal responsibilities of each committee are described below. Actions taken by any committee of our Board are reported to the Board, usually at the meeting following such action. MembershipEach of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee is each composed of three Trustees who are each "independent"“independent” as defined under theSEC rules and regulations and listing standards of the NYSE. Our Board may from time to time establish other committees to facilitate the management of our company. Copies of the charters of the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee are posted on our websiteavailable at www.uedge.com under "About“About Us - Governance."” The information contained on or available through our website is not part of this Proxy Statement.

TABLE OF CONTENTS

The table below sets forth a summary of our committee structure and membership information.

Trustee | | | | | | | |

| Trustee | | Audit Committee | | Compensation Committee | Compensation

Committee | | | Corporate Governance and

Nomination Committee |

Norman K. Jenkins(1) | Michael A. Gould* | | | | l | • | l | | Chair |

Mary L. Baglivo | | | | | | • | | | • |

Steven H. Grapstein | | l | | | | Chair | | | |

Kevin P. O'Shea† | Steven J. Guttman | | Chair | | l | • | | | |

Catherine D. Rice†(2) | Amy B. Lane | | l• | | Chair | | | | • |

Katherine M. Sandstrom† | Kevin P. O'Shea† | | Chair• | | | | l | | • |

Douglas W. Sesler | | | • | | | | | | |

*(1)

| Mr. Jenkins is the Company’s current Lead Trustee and is expected to continue in that role for the May 2024 to May 2025 Board term. |

(2)

| | | | | | Ms. Rice has been elected Chair of the Audit Committee, effective April 1, 2024. Mr. O’Shea will remain a member of the Audit Committee thereafter. |

†

| Audit Committee Financial Expert | | | | |

Audit Committee

The Audit Committee’s purposesmain responsibilities are (i) to (i) assist the Board in its oversight of (a) the integrity of our financial statements, (b) our compliance with legal and regulatory requirements, (c) the independent registered public accounting firm’s qualifications and independence, and (d) the performance of the independent registered public accounting firm and the company’s internal audit function; and (ii) to prepare an Audit Committee report as required by the SEC for inclusion in our annual proxy statement. The function of the Audit Committee is oversight. Management is responsible for the preparation, presentation and integrity of our financial statements and for the effectiveness of internal control over financial reporting. Management is also responsible for maintaining appropriate accounting and financial reporting principles and policies and internal controls and procedures that provide for compliance with accounting standards and applicable laws and regulations. AnOur independent registered public accounting firm is responsible for planning and carrying out a proper audit of our annual financial statements, reviewing our quarterly financial statements prior to the filing of each Quarterly Report on Form 10-Q and annually auditing the effectiveness of internal control over financial reporting and other procedures. Additional information regarding the Audit Committee's duties and responsibilities may be found on our websiteis available at www.uedge.com under "About“About Us - Governance - Audit Committee Charter."

” The information contained on or available through our website is not part of this Proxy Statement.

Each member of the Audit Committee is financially literate, knowledgeable and qualified to review financial statements, and is

"independent"“independent” as defined under

theSEC rules

and regulations and listing standards of the NYSE. The Board determined that

each of Mr. O'Shea

the Chair of the Audit Committee, qualifiesand Mses. Sandstrom and Rice qualify as an

"Audit“Audit Committee Financial Expert,

"” as defined in Item 401(h) of Regulation S-K.

AThe report of the Audit Committee may be found on page

22.30 of this Proxy Statement.

Compensation Committee

The Compensation Committee is responsible for establishing and approving the terms of the compensation of theour executive officers and the granting and administration of awards under the Company’s 2015 Omnibus Share Plan.incentive plan. Compensation decisions for our executive officers are madereviewed and approved by the Compensation Committee. Decisions regarding compensation of other employees are made by our Chief Executive Officer and arewith equity awards to employees subject to the review and approval of the Compensation Committee. The Compensation Committee has authority under its charter to select, retain and approve fees for, and to terminate the engagement of, independent compensation consultants, outside legal counsel or other advisors as it deems appropriate without seeking approval of the Board or management. Additional information regarding the Compensation Committee's duties and responsibilities may be found on our websiteis available at www.uedge.com under "About“About Us - Governance - Compensation Committee Charter."” The information contained on or available through our website is not part of this Proxy Statement.

TABLE OF CONTENTS

Each member of the Compensation Committee is

"independent"“independent” as defined under

theSEC rules

and regulations and listing standards of the NYSE.

AThe report of the Compensation Committee may be found on page

47.58 of this Proxy Statement.Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee’s responsibilities include, among others, the selection of potential candidates for the Board, review of our corporate governance framework, oversight of the Company’s cybersecurity and the developmentother information security risks and related policies and procedures, and review of our Governance Guidelines.the Company’s ESG strategy, practices and policies and reporting to the Board thereon. It also reviews Trustee compensation and benefits, and oversees annual self-evaluations of the Board and its committees. The committeeCorporate Governance and Nominating Committee also makes recommendations to the Board concerning the structure and membership of the other Board committees, as well as management succession plans. The committeeCorporate Governance and Nominating Committee selects and evaluates candidates for membership to the Board in accordance with the criteria set out in the Company’sCorporate Governance Guidelines, a summary of which is provided below. The committeeCorporate Governance and Nominating Committee is then responsible for recommending to the Board a slate of candidates for Trustee positions for the Board’s approval. Additional information regarding the Corporate Governance and Nominating

Committee's duties and responsibilities may be found on our websiteis available at www.uedge.com under "About“About Us - Governance - Corporate Governance and Nominating Committee Charter."

” The information contained on or available through our website is not part of this Proxy Statement.

Each member of the Corporate Governance and Nominating Committee is "independent"“independent” as defined under theSEC rules and regulations and listing standards of the NYSE.

Role of the Board and its Committees in Risk Oversight

One of the key functions of the Board is informed oversight of our risk management process. The Board administers this oversight function directly, with support from the Audit Committee, the Compensation Committee and the Corporate Governance and Nominating Committee, each of which addresses risks specific to their respective areas of oversight. In addition to receiving information from its committees, the Board receives updates directly from members of management. In particular, Mr. Olson, due to his management position, is able to frequently communicate with other members of our management team and update the Board on the important aspects of our day-to-day operations. The full Board also oversees strategic and operational risks.

Financial and Accounting

The Board and the Audit Committee oversees ourmonitor the Company's financial and regulatory risk policiesthrough regular reviews with management and processes relating to our financial statementsinternal and financial reporting processes, as well as key credit risks, liquidity risks, market risksexternal auditors and compliance, and the guidelines, policies and processes for monitoring and mitigating those risks. The Audit Committee also monitors risks arising from related person transactions. The Audit Committee meetsother advisors. In its periodic meetings with the audit partner of ourinternal auditors and the independent registered public accounting firm, that conducts the Audit Committee discusses the scope and plan for the internal audit and the audit conducted by the independent registered accounting firm, and includes management in its review of internalaccounting and financial controls over financial reporting to discuss the annual audit plan and any issues that such partner believes warrant attention.assessment of business risks.

Governance and Succession

The Compensation Committee oversees risk management as it relates to our compensation plans, policiesBoard and practices in connection with structuring our executive compensation programs and reviewing our incentive compensation programs for other employees and has reviewed with management whether our compensation programs may create incentives for our employees to take excessive or inappropriate risks which could have a material adverse effect on us.

Thethe Corporate Governance and Nominating Committee overseesmonitor the Company's corporate governance policies and procedures by regular review with management and outside advisors. The Board and the Corporate Governance and Nominating Committee monitor CEO and management succession, and the Compensation Committee monitors the Company's compensation policies as applied to executive officers and related risks by regular reviews with management and the Committee's outside advisors.

Cybersecurity

Cybersecurity is an integral part of the Board of Trustees’, Audit Committee’s and the Corporate Governance and Nominating Committee’s risk analysis and discussions with management. In February 2023, the Board assigned cybersecurity oversight responsibility to the Corporate Governance and Nominating Committee via

TABLE OF CONTENTS

an amendment to the Committee’s Charter (which is available at www.uedge.com under “About Us - Governance”). As we see increased reliance on information technology in the workplace and our business operations, and an ongoing shift to remote and hybrid work schedules, Urban Edge has employed several measures to mitigate cyber risks.

In addition to a dedicated information technology and cybersecurity team monitoring our daily operations, the Company engages an independent third-party cybersecurity audit firm to periodically review cybersecurity risks and our Incident Response Program. We also have a Cyber Steering Committee which works in conjunction with the Computer Incident Response Team (“CIRT”) to develop strategies to mitigate risks and to address any cyber issues that may arise. The Cyber Steering Committee meets (i) at least quarterly to review emerging threats, controls, and procedures, (ii) at least annually with the Corporate Governance and Nominating Committee to discuss trends in cyber risks and our strategy to defend our information against cybersecurity incidents, and (iii) promptly following the occurrence of a material cyber incident.

We utilize a risk-based approach that aligns with the National Institute of Standards and Technology Cybersecurity Framework, and Microsoft best practices. Our policies and procedures are reviewed and updated annually by the Cyber Steering Committee and incorporate third-party assessments to benchmark ourselves against industry standards. The Company utilizes advanced endpoint protection, firewalls, intrusion detection and prevention, threat intelligence, security event logging and correlation, and backup and redundancy systems.

We have formal policies and procedures addressing data retention, incident response, asset and device management and have a Disaster Recovery and Business Continuity Committee that meets biannually to review and update our plan, policies, and procedures to align with changes in risk assessment and emerging technologies. In addition, our Information Technology team conducts disaster recovery tests annually and reports results to the Cyber Steering Committee. Cyber threats identified are communicated to all members of the Company via email to promote awareness and assist with protecting us from potential risks or breaches. All employees are required to undergo quarterly security awareness trainings and we routinely conduct internal phishing and other exercises to gauge the effectiveness of the trainings and assess the need for continued education and/or areas where improvement may be needed.

The Company also maintains a cyber liability insurance policy, at levels that we believe are market and appropriate to our industry, intended to respond to breaches of network security, loss of sensitive and personal information, ransom attacks and other cybersecurity incidents. In the past three years, we have not experienced a material information security breach. As such, we have not incurred any material expenses from cybersecurity breaches or any expenses from penalties or settlements related to among other matters, our governance structure and processes, succession planning, potential conflicta cybersecurity breach during that time.

Compensation

As part of interest, and violationsits oversight of the Company's Codeexecutive compensation program, the Compensation Committee considers the impact of Business Conductthe Company's executive compensation program, and Ethics.

the incentives created by the compensation awards that it administers, on the Company's risk profile. In addition, the Company reviews all of its compensation policies and procedures, including the incentives that they create and factors that may reduce the likelihood of excessive risk taking, to determine whether they present a significant risk to the Company.

Compensation Committee Interlocks and Insider Participation

During 2017,2023, the following trustees,Trustees, all of whom are "independent"“independent” as defined under theSEC rules and regulations and listing standards of the NYSE, served on our Compensation Committee: Michael A. Gould, Steven J. GuttmanH. Grapstein (Chair), Mary L. Baglivo, Norman K. Jenkins and Amy B. Lane.Kevin P. O'Shea. None of our executive officers serve as either a member of the Board of Directorsboard or the compensation committee of any other company that has any executive officers serving as a member of our Board or Compensation Committee.

Board and Committee Meetings

In 2017,2023, the Board held tenfive meetings, the Audit Committee held six meetings, the Compensation Committee held six meetings and the Corporate Governance and Nominating Committee held sixfour meetings. EachIn 2023, each incumbent Trustee attended allat least 75% of (i) the total number of meetings of the Board held during the

TABLE OF CONTENTS

period for which he or she was a Trustee (except for Mr. Guttman, who is not re-running as Trustee for the 2024-2025 board term) and (ii) the total number of meetings and their respective committeeof all committees of the Board on which the Trustee served during the periods that he or she served.

The Board does not have a formal policy regarding the attendance of Trustees at our annual meetings in 2017. We held ourof shareholders but encourages all Trustees to make attendance a priority. Our 2023 annual meeting of shareholders on May 10, 2017, which was attended by all Trustees.Trustees except Mr. Guttman.

The independent Trustees of our Board have the opportunity to meet in executive session, without management present, at each Board and committee meeting. The Lead Trustee presides over independent, non-management sessions of the Board.

Nomination of Trustees